U.S. Economic Performance 2017 – 2024

Economic conditions for most Americans improved during the Biden/Harris administration, but some feel dissatisfied, primarily with the price of essential goods. The facts show that Biden did a better job than Trump and that most people are better off since Biden/Harris took office as President. Here are some quick reference facts; the details follow.

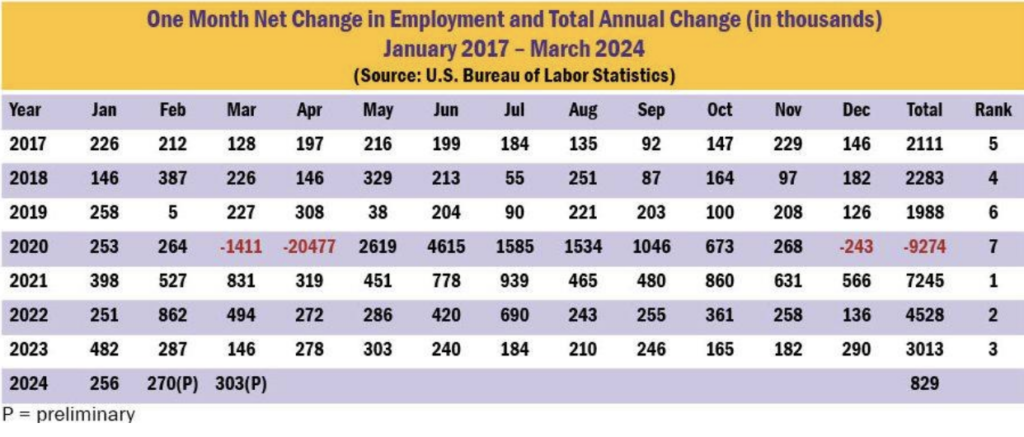

Job Growth: More than 16 million jobs have been added during Biden’s term (2021-2024). Trump added only 6.9 million between 2017 and March 2020’s massive COVID job losses.

Unemployment: Reduced from 6.4% in January 2021 to 3.4% in January 2023; 3.8% in March 2024; 4.3% in July 2024 (historically considered “full employment”) due to Federal Reserve monetary policy keeping interest rates high.

Inflation: A global problem, a consequence of COVID-related shutdowns and supply line snarls. In the U.S., bipartisan responses under both Trump and Biden to aid Americans

contributed to increase demand for scarce goods. Steadily reduced rate under Biden.

Food Inflation: Food inflation in 2019 (before COVID) under Trump was 1.8%. It has been lower in the U.S. than in Europe or the UK over five years between COVID onset in March

2020 and February 2024. The annualized rate for food inflation was 2.2% in February 2024. The monthly change in food at home prices for February and March was 0.00%.

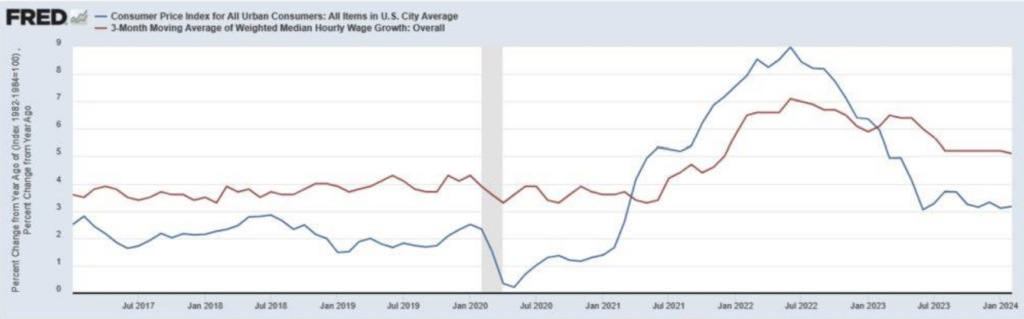

Wage Growth: Wage gains have exceeded the inflation rate every month since February 2023 (18 consecutive months) as food price increases have moderated or declined.

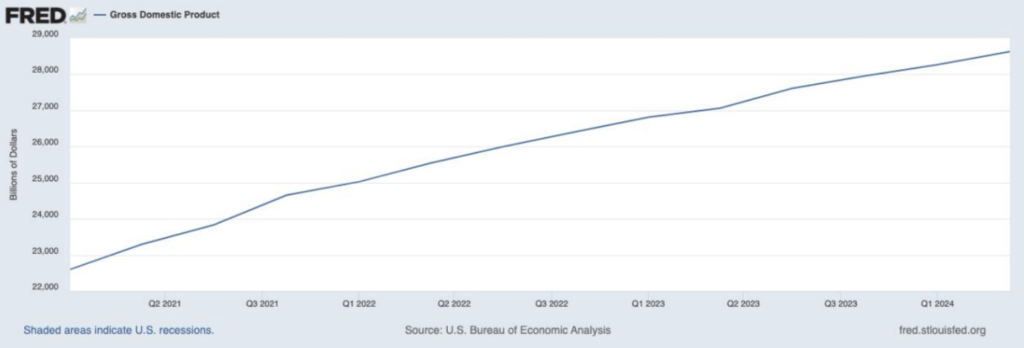

Economic Growth: The U.S. Gross Domestic Product (or GDP) grew by $6 trillion under the Biden administration, whereas it grew by only $3.3 trillion under President Trump.

Job Growth

In June 2024, there were 8.18 million job openings in the U.S., more than one for every unemployed working in the labor market. Throughout 2024 there have been over 8 million job openings each month. In Trump’s last full months in office (November and December 2019) there were only 6.79 and 6.42 million job openings (respectively).

The chart below reflects net job gains / losses between 2017 (when Trump became President) and 2024. Ranking performance best to worst: Biden gets first, second and third place (with 2024 trending toward fourth best). Trump gets fourth, fifth, sixth and seventh (with 2020 being the worst year for jobs in the twenty-first century). Admittedly, the dramatic loss in 2020 was due to COVID-19, but that drop of 9.2 million was more than erased by gains of 7.2 million in 2021 and 4.5 million in 2022, followed by another 3 million in 2023. The most net jobs during Trump’s term were 2.3 million in 2018.

Manufacturing jobs have increased by 6.3% (800,000 jobs) since January 2021. During Trump’s administration (January 2017 – December 2019, before COVID hit) only 432,000 manufacturing jobs were created.

Unemployment

The unemployment rate was 6.4% when Biden took office in January 2021. By December 2021 it was down to 3.9% and remained at or significantly below 4% until touching 4.3% in July 2024 in response to the Federal Reserve’s efforts to cool the economy and control inflation. Biden has no control over Federal Reserve policies. Speaking of inflation, it is a global problem.

Inflation

Global shutdowns in response to COVID-19 snarled supply chains across the world economy. Russia’s invasion of Ukraine which disrupted both energy and food markets (Russia being a leading energy exporter and Ukraine a leading grain exporter). Both Trump and Biden replaced lost wages, which fueled customer demand while goods supplies were

reduced. The Federal Reserve’s confidence that inflation was “transitory” delayed their response to rising prices, allowing inflation to surge.

Disrupted supply chains both increased actual costs and covered corporations’ increases to profit margins (over and above labor and production costs). While this benefitted people invested in the stock market, it impacts everyone by increasing the prices paid at checkout. After-tax profits in 2021 and 2022 were at the highest level since the early 1950s. Corporate profits in the fourth quarter of 2023 were approximately double what they were in the fourth quarter of 2019.

No category is more dearly felt than food – which, too, is global.

The rate of food inflation has been steadily declining since August 2022; from 8.5% in May 2023 to 2.2% in February 2024. The 2.2% was the lowest rate for food inflation in almost three years, matching the rate in May 2021. The monthly change in food at home prices for February and March 2024 was 0.00%. Again, this is a global issue, not due to Biden:

Wage & Economic Market Growth

The story is mixed but a strong trend. Wage growth outpaced inflation between January 2017 and March 2021 (continuing a trend that began in May 2012). Between April 2021 and January 2023 inflation exceeded wage growth; consequently, real wages declined. The trend reversed in early 2023, and real wages have increased as the growth in hourly wages has exceeded the rate of inflation since February 2023.

Economic Growth: Personal consumption is approximately two-thirds of GDP and has contributed positively to GDP growth since the third quarter of 2020. GDP has risen steadily since January 2021, totaling $6 trillion (from $22.6 trillion Q1 2021 to $28.6 trillion Q4 2024). Compare the total increase during Trump’s administration $3.3 trillion ($19.3 trillion in Q1 2017 to $22.6 trillion in Q1 2021).

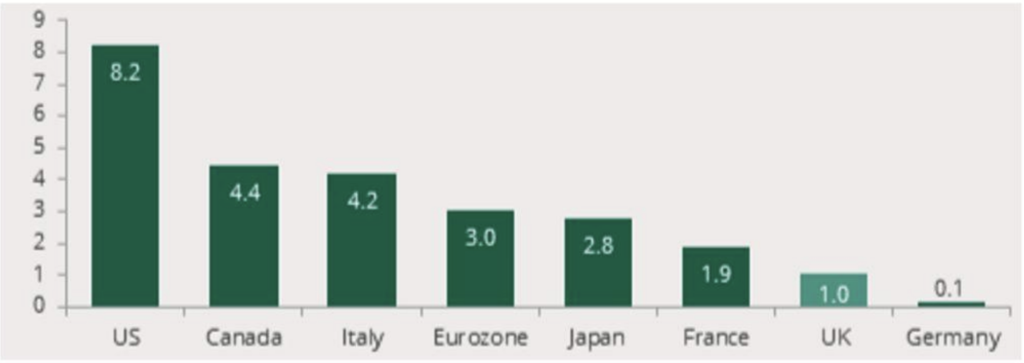

The chart below (data from the OECD) shows the percentage change in GDP (Gross Domestic Product) for G7 countries (leading global advanced economies) between the fourth quarter of 2023 (Biden) compared to the fourth quarter of 2019 (Trump before COVID). The United States had GDP growth of 8.2 percent over the period –- including COVID — almost doubling the GDP growth of Canada, which ranked second.

Financial markets: The Dow, S&P and Nasdaq indices all are at record highs. The S&P 500 index is up over 22% (as of July 31, 2024) from one year ago, nearly 10% annually since Biden took office. If one has an IRA or 401k account, the past years have been good. For savers with bonds or money market funds, earned interest is at rates not seen in decades.